Crude is more likely to break lower toward $60, according to analysts, than rebound on geopolitics. Rising U.S. tariff revenue is cutting the federal deficit, but at the cost of slower global growth and weaker fuel demand. Oil inventories are climbing, and supply from both OPEC+ and non-OPEC producers remains strong. While geopolitical risks – from Israel’s strike in Qatar to U.S. tariff and sanction threats on Russian oil – are supporting prices in the short term, fundamentals point to oversupply. That makes a downside of $60 the dominant risk unless major disruptions tighten the market.

Key takeaways

• WTI crude is at around $63, with downside risks building toward $60

• US tariff revenue surge cuts the federal deficit by $300 billion but slows global growth, dampening oil demand.

• Israel’s strike in Qatar raises Gulf security concerns, injecting a risk premium.

Fundamentals point to lower prices

The fundamental picture for oil remains bearish.

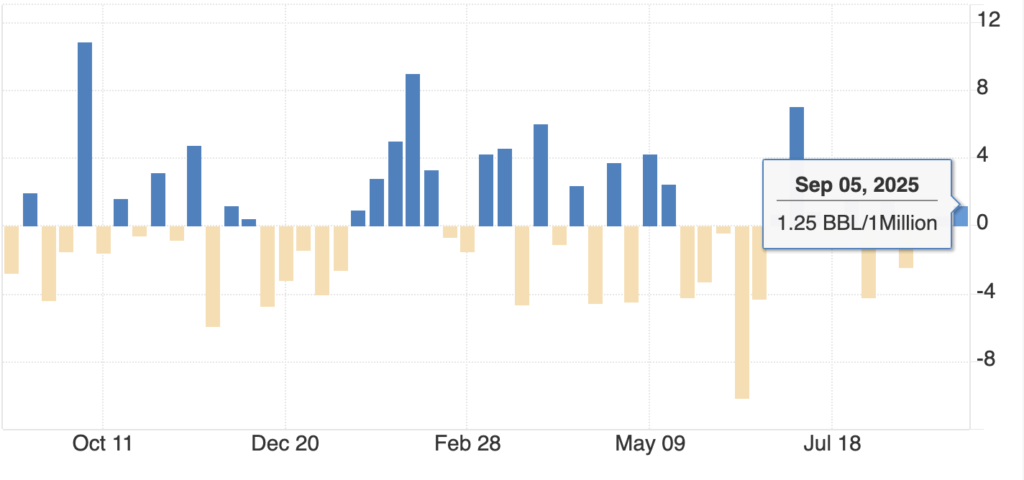

Inventories are climbing: API data for the week ending 5 September showed a 1.25 million barrel build in U.S. crude stocks, confirming that supply is running ahead of demand.

Source: American Petroleum Institute (API)

In a typical market, this would weigh heavily on prices, and traders are already cautious about further builds.

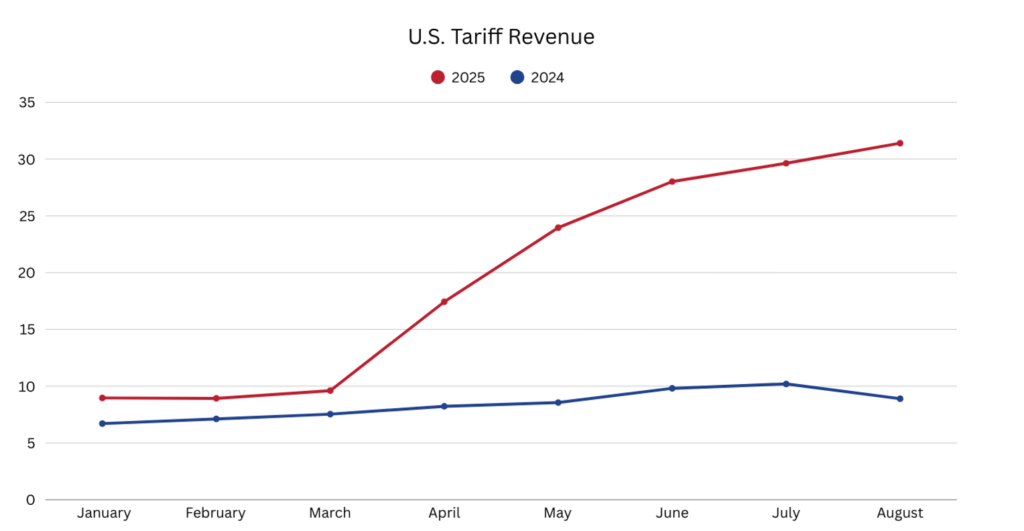

Demand growth is weakening: The surge in U.S. tariff revenue – $31.4 billion in August, $183.6 billion year-to-date – is reducing the deficit but slowing global trade.

Source: US. Department of the Treasury

Reports show retaliation from trading partners has curbed consumer confidence and reduced industrial activity, dragging on fuel use. Global GDP forecasts for 2025 have been revised down by 0.5 percentage points, with U.S. growth also weaker, a trend that directly feeds into lower oil demand.

Supply growth remains robust:

• OPEC+ announced a smaller-than-expected production hike over the weekend, but it still adds barrels into the market.

• Non-OPEC producers led by the U.S., Brazil, and Guyana continue to expand output. In the U.S., technology-driven efficiency gains mean record production even with fewer rigs.

• Taken together, these increases keep the market well supplied despite softening demand.

This dynamic points to WTI testing $60 per barrel, especially if inventories continue to build through September.

Oil market geopolitics risks provide short-term support

Despite weak fundamentals, geopolitical risks are providing support and preventing a sharper selloff. Israel’s strike in Qatar was a rare and destabilising event. Israel targeted Hamas leadership in Doha on Tuesday, with Hamas reporting five casualties.

Qatar hosts the largest U.S. military base in the Middle East and has been a key mediator in peace talks. The strike rattled markets, pushing oil up nearly 2% before gains were trimmed after U.S. officials downplayed the likelihood of repeat attacks. Still, the incident has injected a fresh risk premium tied to Gulf instability.

U.S. pressure on Russian oil flows is also in focus. According to Reuters, Trump has pushed for more restrictions on Moscow’s crude exports, calling for 100% tariffs on India and China if they continue buying Russian oil.

India already faces a 50% tariff. If enforced, these measures could reduce Russian revenues and disrupt flows to key buyers, supporting global oil prices. For now, India and China have resisted Western pressure, but the threat alone is enough to buoy sentiment.

Tariffs and the dollar complicate the picture

The fiscal impact of rising U.S. tariff revenue is clear. Year-to-date collections of $183.6 billion could exceed $300 billion by year-end, trimming the U.S. budget deficit by a similar amount. According to forecasts, this fiscal relief could strengthen the U.S. dollar.

For oil, however, a stronger dollar is a double-edged sword:

• It makes crude more expensive for buyers outside the U.S., reducing demand.

•It pressures exporters, who earn less in local currency terms.

Combined with slower global growth from trade tensions, the tariff story weighs more on demand than on supply, reinforcing the bearish case.

Market impact and price scenarios

The balance of risks points to continued volatility.

- Bearish scenario: Fundamentals dominate. Rising inventories and slowing demand push WTI down to $60, with risks extending into the $50–55 range if surpluses build through 2026.

- Bullish scenario: Geopolitics flare up. Gulf instability or harsher U.S. sanctions on Russia add a risk premium, supporting crude near $65–70 in the short term.

- Base case: A push–pull market where WTI trades between $60 and $70, with direction driven by headlines more than fundamentals.

Disclaimer: The performance figures quoted are not a guarantee of future performance.

Leave a Reply