US manufacturing is improving, with the ISM PMI at 48.7 in August and new orders back in growth, but the dollar remains weak due to tariffs, softening jobs, and possible Fed rate cuts. While the factory slump may be easing, a dollar rebound isn’t certain.

Key takeaways

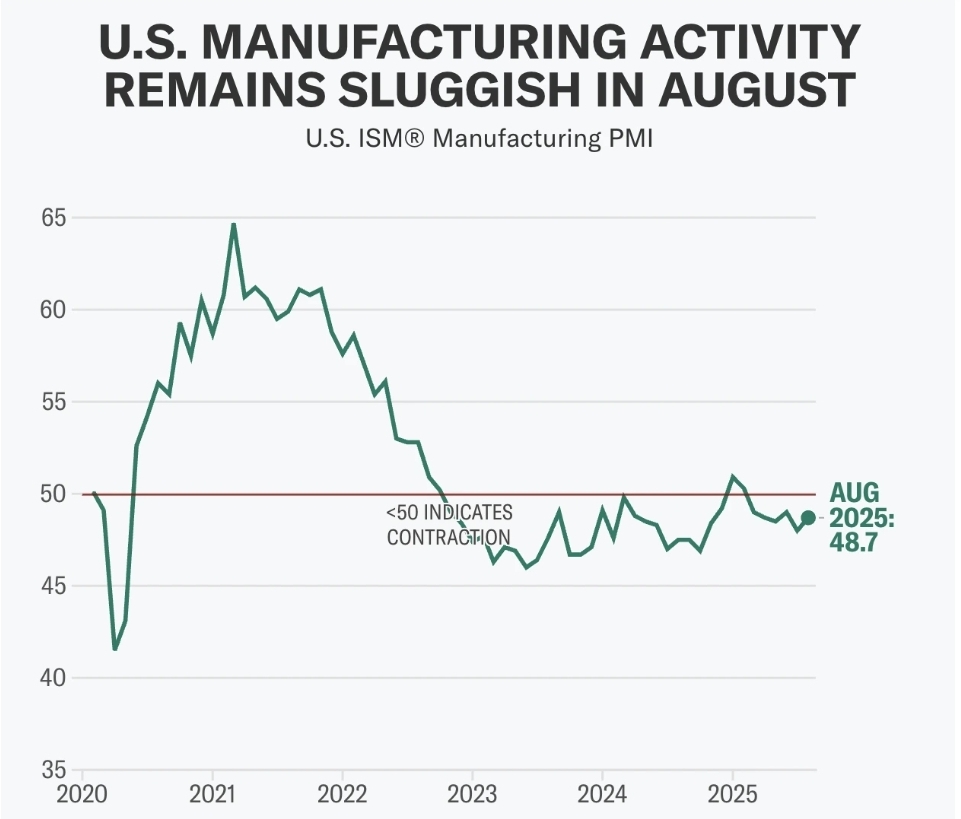

• ISM Manufacturing PMI rose to 48.7 in August, with new orders at 51.4, the first expansion since January.

• Tariff pressures remain high, with 75% duties on Chinese imports and 25% on Canada, Mexico, and the EU, raising costs for US firms.

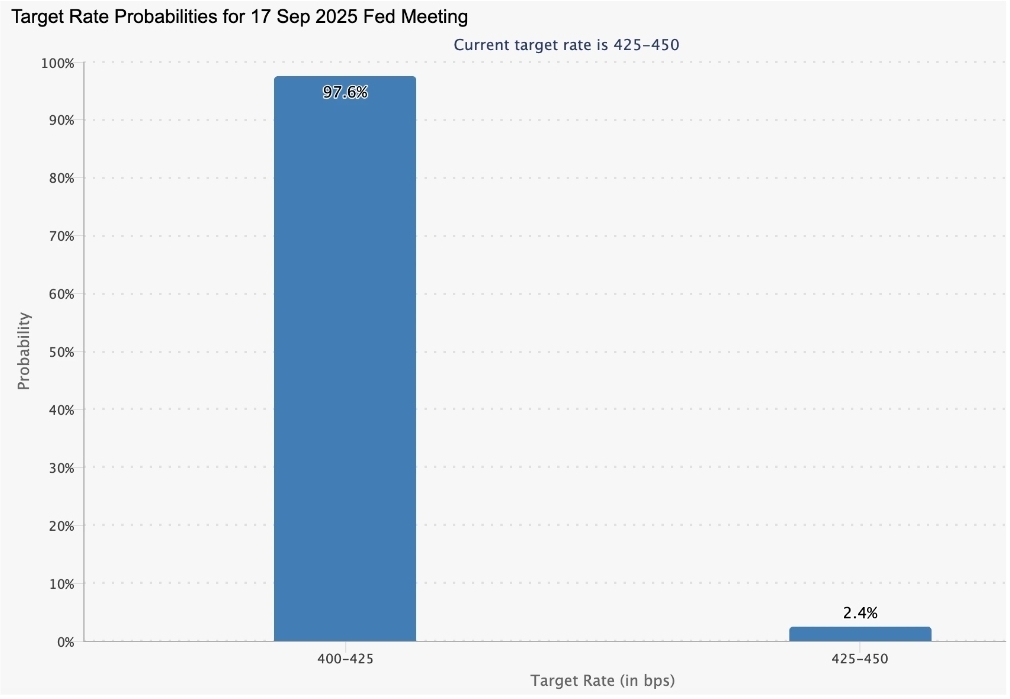

• Fed outlook is dovish, with a 99% probability priced in for a 25 bps September cut, despite green shoots in manufacturing.

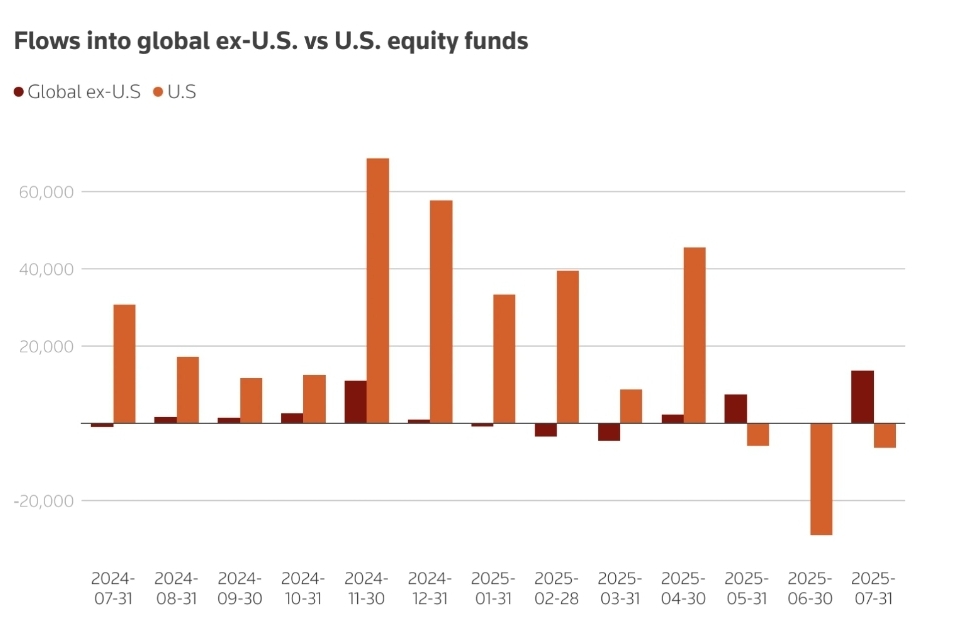

• Capital flows are shifting away from the US, with European ETFs seeing $42 billion of inflows while US inflows halved in 2025.

• Employment lags, with the ISM jobs index at 43.8 and national unemployment at 4.2%–4.3%, underscoring fragile labour conditions.

ISM Manufacturing PMI shows first signs of recovery

The ISM Manufacturing PMI increased by 0.7 points in August to 48.7, its highest since late 2024.

Source: Institute for Supply Management, Yahoo Finance

New orders in US manufacturing rose to 51.4, signaling future demand growth, while input costs eased slightly. However, employment remains weak at 43.8. Though manufacturing is just over 10% of GDP, it strongly influences sentiment and capital flows, with past PMI gains often boosting the USD in the short term.

What this could mean for the dollar

Experts say a manufacturing recovery could support the USD through three main channels:

- Growth signal: Expansion in new orders suggests stronger demand, which could boost confidence in the US growth outlook and attract global capital inflows.

- Monetary policy: Signs of resilience may reduce pressure on the Federal Reserve to deliver deep rate cuts, supporting USD yields. In early 2025, the dollar rallied against the euro from 1.12 to 1.02 as markets scaled back easing calls.

- Trade balance: A recovery in exports could narrow the deficit, strengthening the USD. However, a stronger dollar and tariff costs continue to undermine the competitiveness of US goods.

Counterweights to a stronger dollar

Tariff headwinds

The Trump administration’s 2025 tariff package – 75% on Chinese imports, 25% on Canada, Mexico, and the EU – has raised costs on intermediate goods, which make up about half of all US imports. Economists estimate the tariffs represent a $430 billion tax increase, equivalent to 1.4% of GDP. This risks slowing growth and limiting manufacturing’s rebound. At the same time, tariffs tend to push the USD higher by increasing demand for dollar-based transactions, making US exports less competitive.

Capital outflows

Foreign investors are reallocating away from US markets. Net flows into US equity ETFs dropped to $5.7 billion in 2025, compared with $10.2 billion a year earlier. By contrast, European investors redirected $42 billion into local ETFs. This reduces structural support for the USD, even if manufacturing data improves.

Source: LSEG Lipper

Employment weakness

The ISM Employment Index rose only 0.4 points to 43.8, still signalling contraction. Nationally, payroll growth has slowed, with July adding just 73,000 jobs and unemployment edging up to 4.2%. Economists such as Mark Zandi warn that if job declines accelerate, the economy is “on the precipice” of recession, which would erode USD support.

Federal reserve rate cut outlook rate cut outlook

The Federal Reserve has kept rates at 4.25%–4.50% through mid-2025, balancing above-target inflation with weaker growth. Markets are now pricing a near-100% probability of a 25 bps September cut, up from 89% just a week earlier, after July JOLTS job openings fell to 7.18 million – the weakest since September 2024.

Source: CME

Fed officials are divided:

- Neel Kashkari has warned that tariffs are raising consumer costs, keeping inflation sticky.

- Raphael Bostic acknowledges inflation risks but sees labour weakness pointing to a single cut this year.

- Political tension has heightened after Trump’s comments about replacing Jerome Powell, though Fed nominee Stephen Miran pledged to uphold central bank independence.

This policy uncertainty adds volatility to USD trading.

Market impact and scenarios

• Bullish USD case: Sustained PMI gains push the index above 50, reducing Fed cut expectations and attracting inflows. This could lift the USD against peers, with forecasts pointing to EUR/USD near 1.19 and USD/JPY at 141 by late 2025.

• Bearish USD case: Tariff costs, capital outflows, and weak jobs undercut recovery, driving the dollar lower. J.P. Morgan projects EUR/USD at 1.22 by March 2026.

• Neutral case: Modest manufacturing gains are offset by dovish Fed policy, keeping the USD range-bound around current levels.

Investors are expected to monitor PMI releases, labour data, and tariff developments closely. Tactical opportunities may emerge around PMI-driven rallies, but medium-term positioning should hedge against downside risks if recovery momentum stalls.

Leave a Reply