Gold prices at $3,700 per ounce are signalling rising U.S. recession risks, with Moody’s Analytics putting the probability of a downturn at 48% – the highest since the 2020 pandemic. This elevated risk comes as the labour market weakens, the Federal Reserve begins a rate-cutting cycle, and inflationary pressures persist. Analysts warn that if a recession unfolds, gold could advance by another 10–25%, testing the $4,000–$4,500 range within the next 12–18 months.

Key takeaways

• U.S. recession probability at 48% (Moody’s) after a major labour market data revision by the BLS.

• Fed rate cuts lower real yields, supporting gold’s appeal as a non-yielding safe haven.

• Gold demand is resilient, with record ETF inflows, strong Indian buying, and central bank diversification.

• Short-term headwinds include rising Treasury yields and a rebounding U.S. dollar.

• Historical precedent shows gold typically gains ~25% in recession years (2008, 2020).

Labour market weakness raises US recession risk

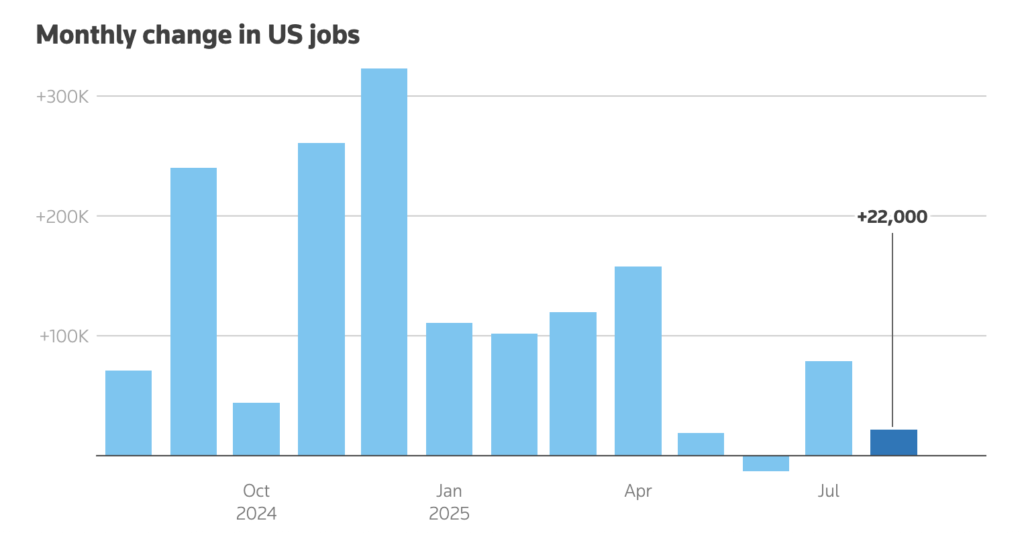

Concerns over a U.S. slowdown have intensified after the Bureau of Labour Statistics revised down the number of jobs created by 911,000 between April 2024 and March 2025. Payroll growth has remained under 100,000 jobs per month for four consecutive months – a pace that has historically coincided with recessionary periods.

Source: Bureau of Labour Statistics, LSEG

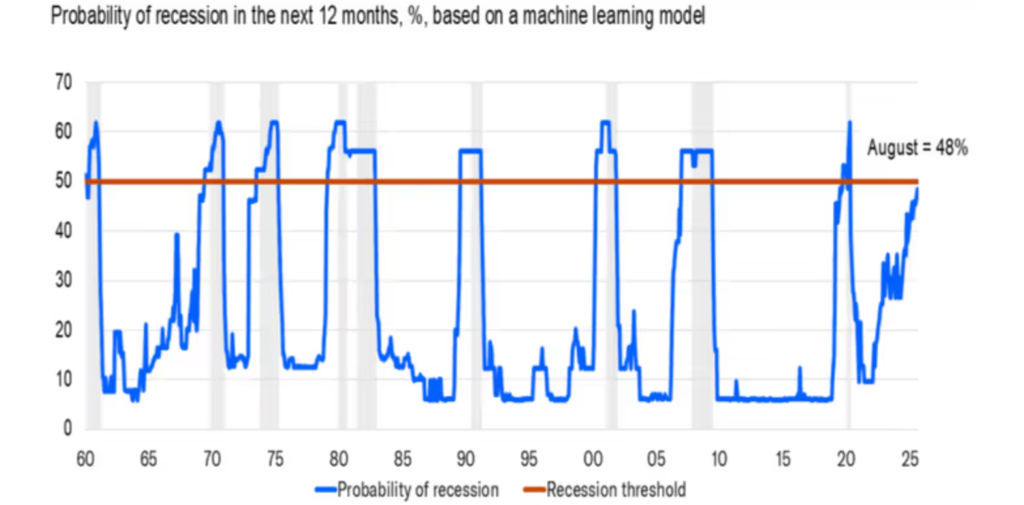

Mark Zandi, chief economist at Moody’s, noted that the odds of recession at 48% are “uncomfortably high,” pointing out that once the probability model crosses 50%, a downturn usually follows.

Source: Moody’s Analytics, Mark Zandi

Strategists like Albert Edwards at Société Générale add that leading labour indicators, including the Kansas City Fed’s Labour Market Conditions Index, are flashing red, even as headline unemployment remains relatively low.

The Fed’s rate cut and its dual impact

The Fed’s first rate cut of 2025, a 25 basis-point reduction in September, propelled spot gold to a record $3,707.40 per ounce. The cut lowered the opportunity cost of holding non-yielding assets, boosting gold’s safe-haven appeal.

However, Fed officials balanced this move with warnings about persistent inflation, which remains above 2.9% due to tariff-related pressures. Chair Powell described the cut as a “risk-management decision,” while Minneapolis Fed President Neel Kashkari highlighted labour market weakness as justification for further easing. Markets now price in as much as 50 bps more cuts by year-end, but the Fed’s “dot plot” signals only two more reductions, suggesting a gradual path.

This mixed messaging has introduced volatility. After hitting record highs, gold pulled back slightly to close at $3,684.93 per ounce, still ending the week with a 1.15% gain. Analyst Bob Haberkorn at RJO Futures argues the pullback is temporary: “Gold is merely taking a breather after hitting new highs; the bull market trend remains intact, and reaching $4,000 by year-end is not out of the question.”

Treasury yields and the dollar: short-term hurdles

Gold’s rally is facing short-term headwinds from U.S. Treasury yields and the dollar. The 10-year Treasury yield climbed to 4.12%, reversing earlier declines and marking a weekly rise of more than 8 bps.

Source: CNBC

The rebound was driven by stronger U.S. jobless claims data and mid-Atlantic manufacturing. Rising yields boosted the dollar, which gained 0.3% to 97.66. Despite a dovish Fed statement, its hawkish dot plot created mixed signals. Higher yields and a stronger dollar pressured gold, though global monetary divergences and fiscal risks abroad continue to support its hedge appeal.

Gold ETF inflows and other Global demand factors

Beyond U.S. policy, global demand and geopolitics remain critical drivers of gold.

• India: Physical demand is robust. Indian gold premiums surged to a 10-month high as buyers stocked up ahead of the festive season, undeterred by record prices.

• China: The opposite trend is visible, with discounts widening to a five-year high, reflecting weaker local demand amid economic challenges.

• Central banks: They continue to diversify reserves, with a projected purchase of 900 tonnes of gold in 2025 after buying 1,037 tonnes in 2024. These purchases are part of a broader de-dollarisation trend.ETFs: Inflows reached $38 billion in H1 2025, lifting holdings to record highs in value terms, a 43% increase year-on-year.

On the geopolitical front, multiple hotspots – Ukraine, Gaza, Poland, the Caribbean, and U.S.-China trade disputes – are amplifying risk aversion. Analyst Rich Checkan argues that this mix creates a “perfect storm” for gold, particularly as fiscal risks in the U.S. (debt surpassing $35 trillion) raise questions about long-term dollar stability.

Historical context: Gold during economic downturn

Gold’s behaviour in past downturns strengthens the case for further gains:

• 2008–09: Prices rose 25%, from $720 to $900, as the global financial crisis forced near-zero rates and spurred safe-haven flows.

• 2020: Gold jumped 25%, from $1,500 to $1,875, during the pandemic recession and multi-trillion-dollar stimulus.

• 2001: Gold posted only a modest 5% gain during a mild slowdown with limited policy easing.

The 2025 setup resembles 2008 more than 2001, with mounting debt concerns, trade tensions, and aggressive central bank buying forming the backdrop for further price gains.

Analysts see gold maintaining a $3,500 floor, with upside toward $4,000–$4,500 if recessionary conditions materialise. Key catalysts to watch include the Q3 GDP release on 30 October and the December FOMC meeting, which will set the tone for monetary policy into 2026.

Disclaimer: The performance figures quoted are not a guarantee of future performance.

Leave a Reply