Oil prices represent the global market value of crude petroleum, serving as a critical economic indicator that affects inflation, energy costs, global trade, and investment strategies. When oil prices move sharply, traders, investors, and policymakers all take notice.

This week, West Texas Intermediate (WTI) crude settled just above $65, marking its highest level since early August. The move was driven by a mix of tighter supplies, renewed geopolitical risks, and surprising U.S. inventory data. But the key question for traders is whether WTI has the momentum to hold above $65 and push toward $70 – or whether returning supplies from Iraq and Kurdistan, alongside U.S. shale’s rising costs, could stall the rally.

Quick Summary

- U.S. inventory drawdown → bullish sentiment → WTI crude pushed above $65

- Ukrainian drone strikes → Russian export bans → tighter global supply

- Rising U.S. shale breakeven costs → reduced flexibility to offset shocks → higher price floors

- Resumption of Iraqi/Kurdistan exports → increased supply → potential cap on gains

- Stronger U.S. GDP growth → robust oil demand but cautious Fed → mixed outlook for global consumption

Price action: Brent and WTI at multi-month highs

- Brent crude, the international benchmark for over two-thirds of global oil, rose 2.48% to $69.31.

- WTI crude, the U.S. benchmark, gained 2.49% to $65.00.

These gains mark the strongest closes since early August, strengthening the bullish momentum in crude markets.

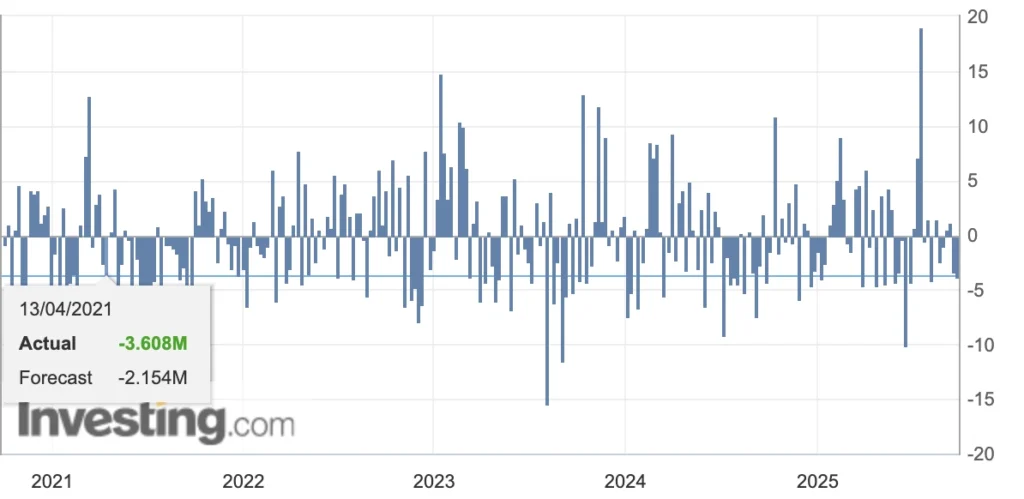

US crude oil inventory data surprises the market

The Energy Information Administration (EIA) – the statistical arm of the U.S. Department of Energy – reported a 607,000-barrel draw in U.S. crude stocks, defying expectations for a 235,000-barrel build.

This broad-based decline across crude, gasoline, and distillates surprised traders and lifted sentiment. Although smaller than the American Petroleum Institute’s 3.8 million-barrel estimate, it was still enough to drive prices higher.

Source: Investing.com

Russia’s oil export ban and geopolitical risks

Russian Deputy Prime Minister Alexander Novak announced an extension of the gasoline export ban and a partial diesel export ban until year-end.

- The move came after Ukrainian drone strikes damaged refineries and pumping stations, cutting Russian refinery runs.

- Russia’s Novorossiisk port declared a state of emergency, highlighting the fragility of export infrastructure under conflict.

With Moscow already constrained by sanctions, every fresh supply disruption amplifies global concerns.

Turkey, Trump, and energy politics

Adding another layer of geopolitical complexity, former U.S. President Donald Trump urged Turkey to halt Russian oil imports in exchange for reconsidering Ankara’s participation in the F-35 fighter jet programme.

While no deal was reached, the message underscores how energy flows remain deeply entangled with foreign policy and defence negotiations. For traders, this introduces additional volatility risk.

Iraq and Kurdistan exports return

The Kurdistan Regional Government announced exports will resume within 48 hours following an agreement with Iraq’s federal government and oil companies.

If supplies return smoothly, this could soften bullish momentum and bring the narrative of oversupply back into play, especially if OPEC+ maintains strong production levels.

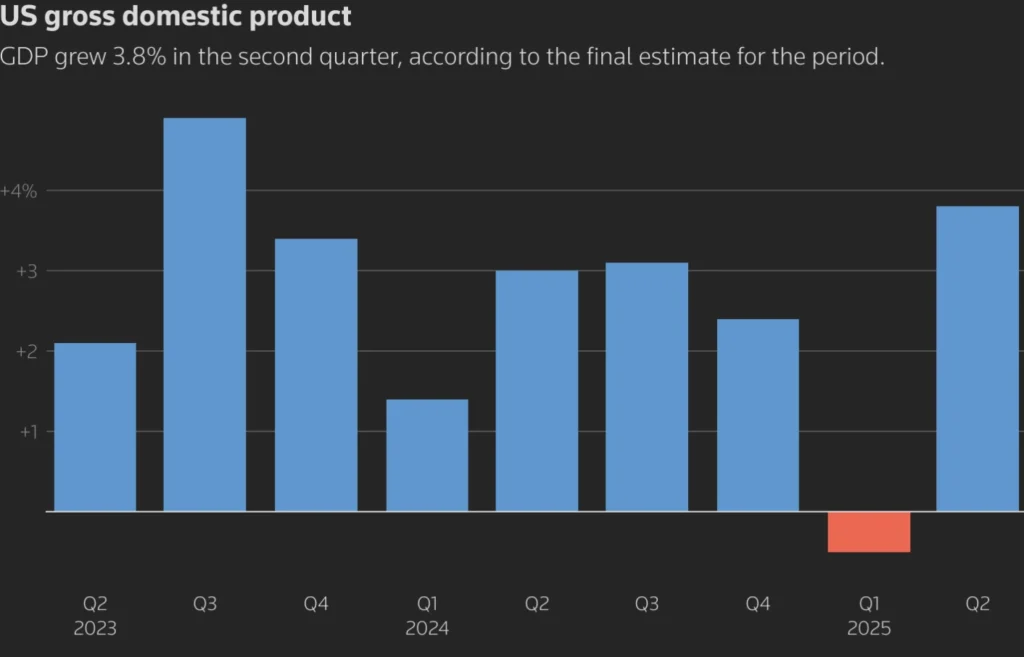

Macro backdrop: Growth vs. Rates

The U.S. economy grew at an annualised 3.8% pace, exceeding expectations.

• Stronger growth → supports oil demand.

• But higher growth → reduces pressure on the Fed to cut rates, tightening financial conditions.

This mixed backdrop suggests resilient consumption, but with a risk that higher borrowing costs could curb global demand.

Source: Bureau of Economic Analysis, LSEG

Disclaimer: The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance. The future performance figures quoted are only estimates and may not be a reliable indicator of future performance.

The performance figures quoted are not a guarantee of future performance.

Leave a Reply