Nvidia’s $100 billion partnership with OpenAI lifted its stock to a record $183.68 this week. Many say the deal positions Nvidia at the centre of the artificial intelligence revolution, but it also raises questions of sustainability. On one hand, the agreement secures Nvidia’s role as the supplier of compute power that OpenAI needs to pursue superintelligence. On the other hand, stretched valuations, regulatory risks, and long delivery timelines may limit the upside.

Key Takeaways

• Nvidia backs OpenAI

• $100B for data center expansion

• Chip maker’s stock hits $4.5 trillion

Nvidia OpenAI partnership

The partnership is among the largest in AI’s history. According to people close to the matter, Nvidia will begin delivering data centre chips to OpenAI in late 2026 and also take a non-controlling equity stake in the company. The two companies have signed a letter of intent for at least 10GW of Nvidia hardware to support OpenAI’s infrastructure. The initial $10B phase is dependent on OpenAI finalising chip purchases. The project’s scale is enormous – it rivals some national power grids – and underscores how compute capacity has become the most valuable currency in AI.

OpenAI is still restructuring into a for-profit company, a process complicated by Microsoft’s existing profit-sharing arrangement and ongoing legal challenges. Nvidia’s entry adds further weight to the governance and strategic direction of one of the world’s most valuable AI companies.

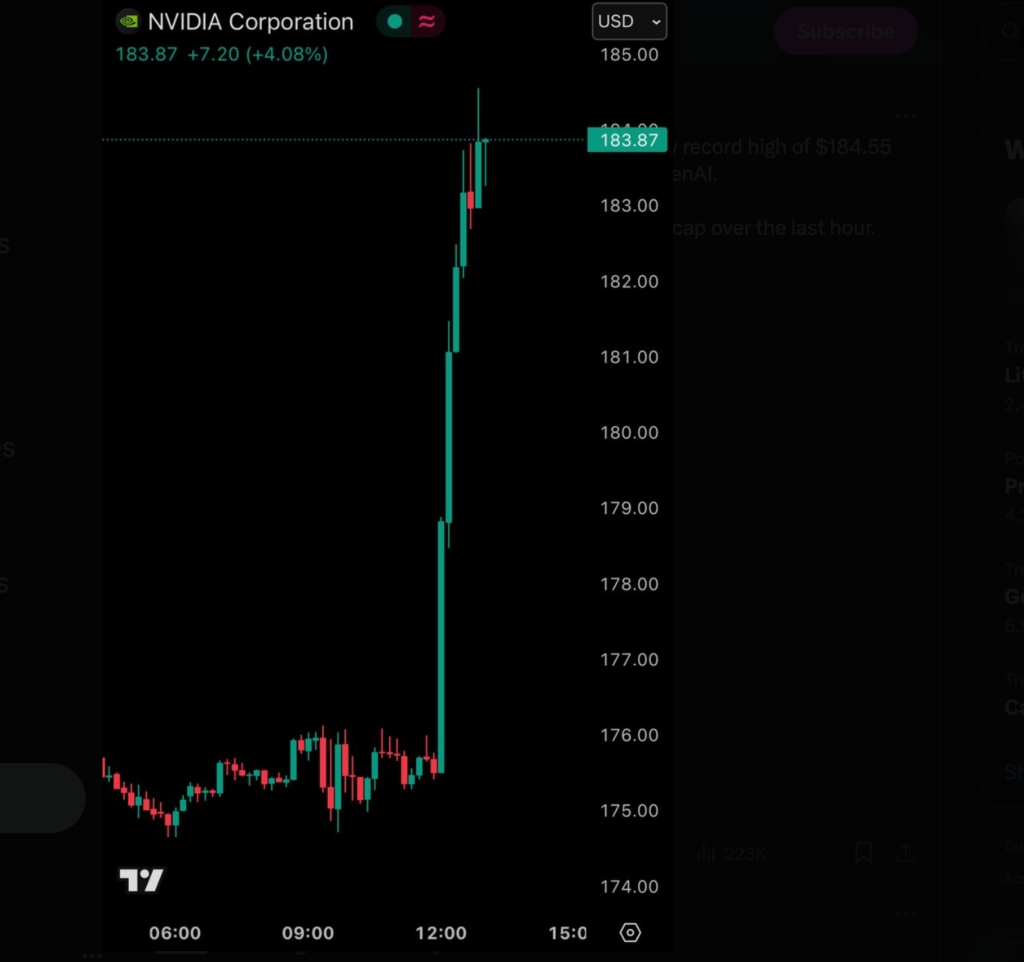

Source: TradingView

NVIDIA’s stock closed at a record $183.68 after announcing a $100B partnership with OpenAI.

Nvidia Bets $100B on OpenAI’s Future

- Nvidia stock NVDA ripped 4% higher Monday after CEO Jensen Huang and OpenAI’s Sam Altman dropped a megaton on CNBC: Nvidia will invest up to $100 billion in OpenAI to fund an unprecedented data center expansion.

- The cash will roll out “progressively as each gigawatt is deployed,” CNBC reported. What it means? Every chunk of new capacity gets a fresh wave of Nvidia’s capital.

- “The stuff that will come out of this superbrain will be remarkable in a way I think we don’t really know how to think about yet,” Altman teased, hinting at AI breakthroughs beyond imagination.

Market Impact

Nvidia’s rally has pushed its market cap to nearly $4.5 trillion, cementing its lead as the world’s most valuable company. To put it in perspective, Nvidia is now worth more than Apple and Microsoft combined just a few years ago.

Meanwhile, Oracle (ORCL) recently surged after news of a $300 billion OpenAI cloud deal, lifting its valuation above $1 trillion for the first time. The key takeaway? OpenAI has become the gravitational center of the AI trade.

Investors are starting to wonder: if you’re not tied to OpenAI, will you even matter? OpenAI itself was recently valued at $500 billion, and the big question now is: How much higher will that number climb in its next valuation round?

Disclaimer:

The performance figures quoted are not a guarantee of future performance.

Leave a Reply