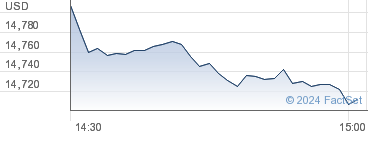

Market Lastest

NASDAQ

14,725

Prices delayed by at least 15 minutes

European shares posted sharp falls on Wednesday as policymakers continued to downplay prospects for early interest rate cuts, after UK inflation rose unexpectedly and weak data from China also hit sentiment. The pan-regional Stoxx 600 index was down 1.26% at 467 in early deals with all major bourses lower after weak sessions in the US and Asia.

Dutch central bank chief and European Central Bank board member Klaas Knot said markets were “getting ahead of themselves” with rate cut expectations.

“The problem for us is that in the end that might become self-defeating. We are optimistic that we have a credible prospect of a return of inflation to 2% in 2025. But a lot still needs to go well for that to happen,”

European Central Bank member Knot said told CNBC.

“Underlying that projection is an interest rate path, assumed interest rate path, that contains significantly less easing than is currently embedded in market pricing. So that runs the risk to become self-defeating.” Meanwhile in the US, Federal Reserve governor Christopher Waller said on Tuesday that interest rate cuts were likely this year, but warned there was “no reason to move as quickly or cut as rapidly as in the past”, although he said the bank was within striking distance of hitting its 2% inflation target.

“When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully,” he added. In the UK, inflation rose unexpectedly to 4% year-on-year in December against expectations of a small fall to 3.8%.

On the European front, the sharp pick-up in eurozone inflation in December was confirmed, according to final estimates from Eurostat, but forecasts suggests price pressures will ease significantly in the coming months – piling pressure on the European Central Bank to cut interest rates.

The harmonised index of consumer prices (HICP) rose 2.9% in December, up from 2.4% in November and matching the initial ‘flash’ figures released two weeks ago.

China’s economy continued to struggle at the end of last year as it recorded another decline in population and fourth-quarter gross domestic product expanded at 5.2%, just missing estimates.

The population fell to 1.4 billion in 2023, with 11 million deaths and 9 million births as the impact of China’s “one-child” policy continued to filter through and add to pressures from deflation and a property sector slowdown.

In equity news, miners were out of favour as the pound rose against the dollar and the China data dampened hopes of a recovery in the world’s second biggest economy and consumer of raw materials. Chile-focused miner Antofagasta was down despite a rise in annual copper production. Glencore was also lower.

IMI rose on an upgrade to ‘buy’ from ‘neutral’ at Goldman Sachs.

Reporting by Henry Schmidt for Tevason.com

Leave a Reply