Ethereum price prediction 2025 has become a key market focus as the token holds near the $4,000 support level. ETH faces immediate headwinds from a negative shift in the Ethereum funding rate and $79.36 million in ETF outflows. Despite these pressures, analysts led by Tom Lee of Fundstrat and BitMine argue that Ethereum remains on track for a rally toward $12,000–$15,000 in 2025 as institutional adoption and BitMine Ethereum holdings strengthen its long-term case.

Key takeaways

- Ethereum price steadies near the $4,000 support level

- Funding rates flipped negative twice this week, pointing to rising short positions.

- Ethereum ETF outflows reached $79.36 million in the past 24 hours.

- Tom Lee projects ETH at $10,000–$12,000 by year-end 2025, with potential upside to $15,000.

Ethereum funding rates go negative

Ethereum funding rates dropped to -0.0013 this week, marking the second negative reading in five days.

Source: Coinalyze

An Ethereum funding rate negative reading occurs when perpetual futures trade below spot, with short traders paying long traders to hold positions. This underscores a bearish tilt in the derivatives market, where traders are positioning for further declines.

Ethereum ETF flows raise caution

The short-term pressure is reinforced by flows in institutional investment vehicles. According to SoSoValue, Ethereum ETF outflows totalled $79.36 million in just 24 hours. This highlights reduced institutional risk appetite and suggests that funds are trimming exposure after months of inflows. While ETF flows can fluctuate, they remain an important gauge of institutional sentiment toward ETH.

Source: SoSoValue

The case for a super cycle

Tom Lee, BitMine’s co-founder and Fundstrat Chairman, forecasts Ethereum will climb to $10,000–$12,000 by the end of 2025, with potential upside to $15,000 if adoption accelerates. BitMine Immersion Technologies has rapidly accumulated 2.4 million ETH, making it the world’s largest Ethereum treasury. Lee places his prediction within a broader 10–15 year Ethereum super cycle driven by:

- Institutional adoption through ETFs and treasuries.

- Governmental alignment with pro-crypto policies.

- AI and automation use cases, with Ethereum as the infrastructure layer.

- Correlation with Bitcoin’s projected $200,000–$250,000 surge.

This long-term view contrasts with short-term pessimism reflected in ETF outflows and negative funding rates, suggesting that volatility may simply be part of Ethereum’s transition into a financial infrastructure asset.

ETH price forecast

At the time of writing, Ethereum is hovering around the $4,000 support level. The ETH price forecast points to two scenarios:

Bearish: If sellers maintain dominance, ETH could retest support at $4,000, with further drawdown toward $3,730.

Bullish: A significant bounce could push ETH higher, with resistance at $4,800.

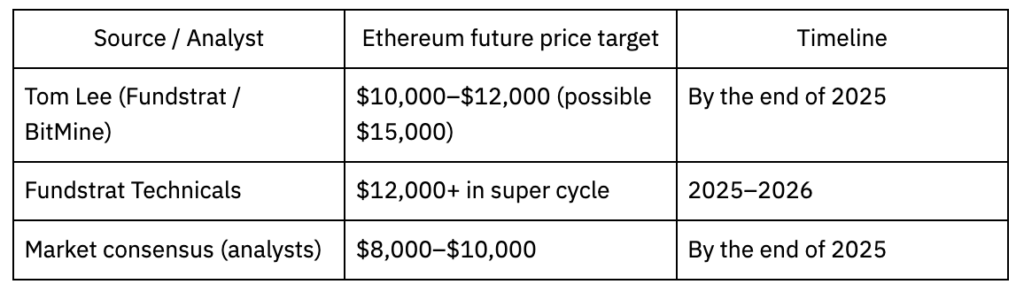

Ethereum future price predictions comparison

For traders, the $4,000 support is the key level to watch. For long-term investors, Ethereum’s role in treasuries, tokenisation, and financial infrastructure suggests that it is building toward a super cycle with targets above $10,000 in 2025.

Disclaimer: The performance figures quoted are not a guarantee of future performance.

Leave a Reply