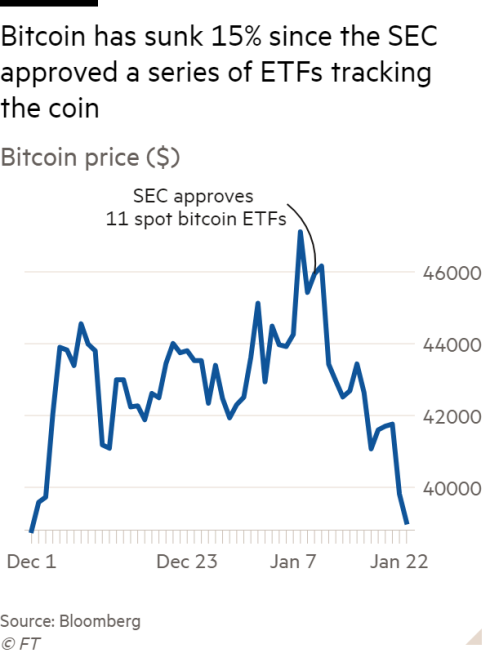

Bitcoin has lost 15 per cent of its value over the past two weeks, as some investors use the much-hyped launch of bitcoin exchange traded funds earlier this month to take profits and exit their holdings of the volatile cryptocurrency.

The price of bitcoin sank as much as 3 per cent on Tuesday, dipping below $39,000 for the first time since early December, before recovering slightly in afternoon trading.

The recent losses have unwound part of a huge rally late last year, which came amid fevered speculation that the launch of mainstream stock market funds tracking the world’s leading crypto token would draw in new investors to bitcoi

But the flows into the ETFs — many launched by big Wall Street players such as BlackRock — have underwhelmed and investors who bought them have been left with hefty losses.

The 10 new funds launched on January 11, after they were approved by the US Securities and Exchange Commission, had collectively pulled in $4.7bn by the end of Tuesday, according to crypto investment group CoinShares. Bitcoin traded at $46,100 on the day the ETFs were launched, but has fallen steadily since.

At the same time, $3.4bn has left Grayscale’s fund, the world’s largest bitcoin investment vehicle, since it converted to an ETF alongside the new launches.

Some have pointed to short-term selling pressure from exits from the Grayscale Bitcoin Trust (GBTC), which has seen about $2 billion in outflows since Jan. 19 while BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund have each seen more than $1 billion in inflow.

Investors have been waiting out this correction, which was expected by many as a “sell the news” phenomenon following the well-telegraphed approval of bitcoin ETFs. Expectations around the event emerged last summer and intensified in August, pushing the bitcoin price steadily higher until it reached a $49k top in the days preceding the ETF approval.

Leave a Reply