Silver has surged over 185% this year, briefly topping $84 an ounce and reaching an estimated $4.65 trillion valuation, making it the world’s second-largest asset. Marking its strongest year since 1979, the rally was quickly followed by sharp volatility, with prices dropping nearly 10% before stabilizing around $75. The sudden swings raise a key question: is silver entering a sustained bull market, or repeating its historic boom-and-bust cycle?

What’s driving Silver’s historic surge?

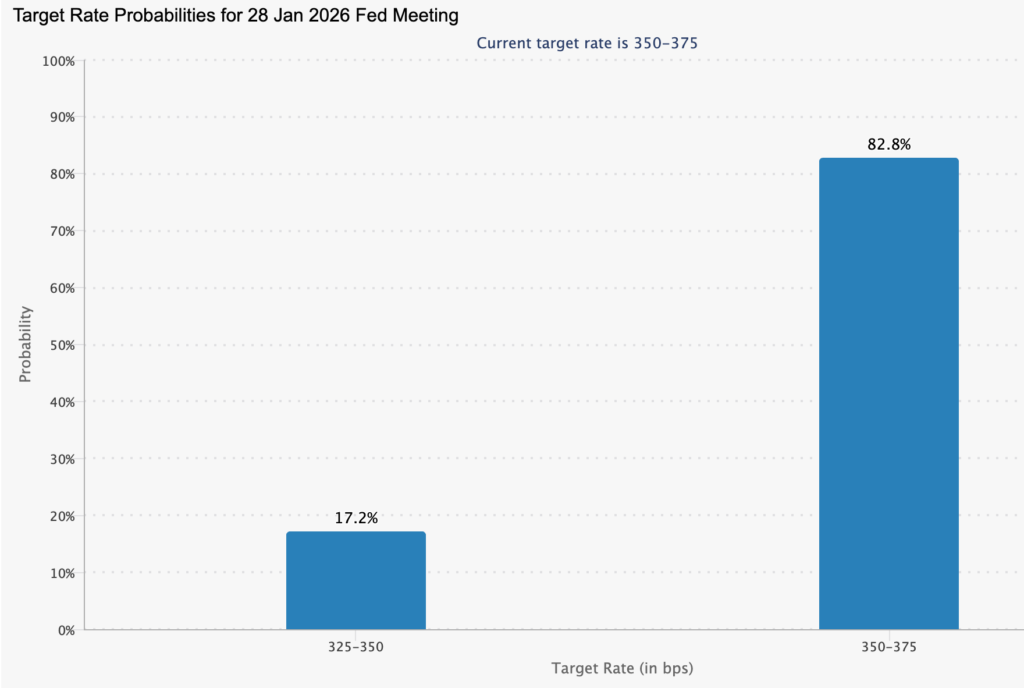

Silver’s rally is being driven by more than speculation. Expectations of future Fed rate cuts, lower real yields, and silver’s dual role as a monetary hedge and industrial metal have boosted demand.

Source: CME

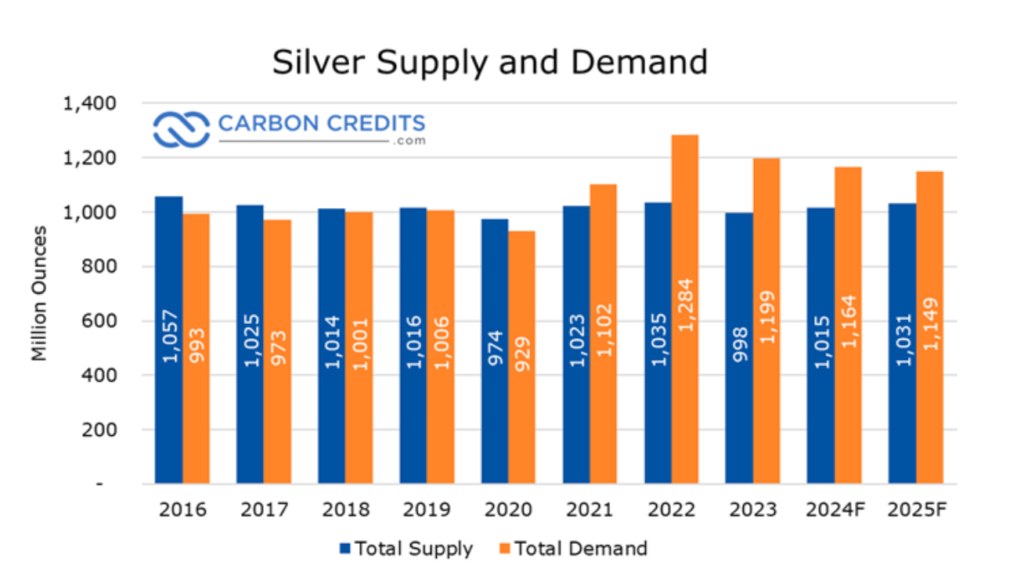

At the same time, the market faces a growing structural supply deficit: 2025 is projected to be the fifth straight year where demand (about 1.12 billion ounces) exceeds supply (around 1.03 billion ounces). Persistent shortfalls estimated at roughly 800 million ounces since 2021 have drained inventories, while mine production has remained largely flat despite higher prices.

Source: Carbon credits

Most silver is produced as a byproduct of other metals, limiting how quickly supply can respond to higher prices, while recycling adds only minimal relief. As a result, rising demand tightens inventories and fuels volatility in futures markets. Policy risks have intensified this strain, with China set to introduce export licensing in 2026. Given its dominance in refined silver, even small export limits could significantly restrict supply, adding a risk premium and increasing market sensitivity to shifts in sentiment.

Why it matters

Silver’s rally matters beyond trading because it is vital to industries like clean energy, EVs, and data centres. Rising prices have raised concerns among manufacturers, including Tesla’s Elon Musk. Analysts are split, with some warning a potential bubble driven by speculative inflows colliding with real supply constraints. The risk is that extreme price moves could distort both financial markets and real-world industrial production.

Impacts on industry and markets

Sustained high silver prices could squeeze key industries, especially solar and EV manufacturing, with analysts warning that prices near $130 an ounce would hurt solar sector margins and slow adoption. In financial markets, rising volatility has prompted the CME to raise margin requirements again, increasing pressure on leveraged traders. Past episodes in 2011 and 1980 show that margin hikes and deleveraging can quickly reverse silver rallies, raising the risk of a sharp correction even if physical demand remains strong.

Expert outlook

The near-term outlook hinges on whether physical demand can absorb the forced selling of futures. COMEX inventories have reportedly fallen by around 70% over the past five years, while China’s domestic silver stocks sit near decade lows. Deeply negative silver swap rates suggest buyers are increasingly demanding real delivery rather than paper exposure.Risks remain elevated. Hedge funds face year-end rebalancing, commodity index adjustments loom, and geopolitical headlines remain fluid. A sustained break below $75 could signal a deeper consolidation phase, while renewed stress in physical markets may quickly revive upside momentum.

For now, silver stands at a crossroads where structural scarcity collides with financial leverage. The coming sessions are likely to determine whether this historic rally matures into a longer-term re-pricing, or fractures under the weight of its own volatility.

Key takeaways

Silver’s surge past Nvidia suggests more than speculative excess. A multi-year structural supply deficit, combined with tightening inventories and rising industrial demand, has collided with leverage-heavy markets. Margin hikes and geopolitical shifts may drive sharp corrections, but the underlying scarcity story appears unresolved. Investors may wish to closely monitor physical inventories, China’s policy signals, and futures market positioning as silver enters its most critical phase.

Leave a Reply