Back in the day, Donald Trump dismissed Bitcoin as something that ‘seems like a scam‘ and claimed crypto’s value was ‘based on thin air.’

But now, times have changed. Since returning to the White House in January 2025, Trump has flipped the script, rolling out executive orders to boost the industry, pushing for wider government adoption of digital assets, and even signing a landmark law legitimizing stablecoins, the class of cryptocurrencies designed to hold steady value.

And he hasn’t stopped there. The US president, along with his family, has expanded their footprint into nearly every corner of the crypto economy, turning what was once doubt into full-blown embrace.

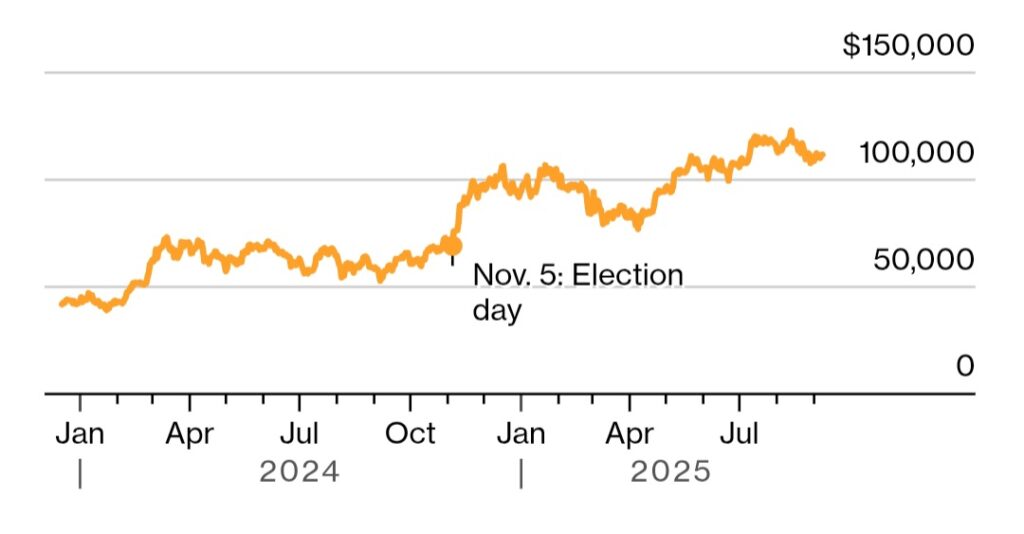

Investors have taken notice. Prices of digital tokens surged after Trump’s election victory in November, especially that of Bitcoin, which hit a record high of more than $125,000 in August 2025.

Donald Trump speaks at the Bitcoin 2024 conference in Nashville, Tennessee, on July 27.

What’s behind Trump’s crypto pivot?

Trump’s change of heart became apparent in recent years when he released four collections of nonfungible tokens (NFTs) — digital pieces of art or collectibles stored on blockchain, the technology underpinning cryptocurrencies featuring heroic images of himself in different costumes and settings.

By the 2024 campaign, Trump had fully embraced crypto, promising to be a “pro-Bitcoin president” and make the U.S. “the crypto capital of the planet.” The crypto industry responded with massive financial support: Elon Musk gave $239 million to a Trump-aligned PAC, venture capitalists Marc Andreessen and Ben Horowitz contributed $2.5 million each, and the Winklevoss twins added $1 million apiece.

The crypto industry poured $135 million into the 2024 elections, mostly via the Fairshake PAC, helping many winning candidates. Support has continued under Trump, with the Winklevoss twins donating $21 million in Bitcoin to advance his pro-crypto agenda. Critics warn of conflicts of interest, with Senator Elizabeth Warren claiming Trump’s policies could “supercharge the value of Donald Trump’s corruption.”

What crypto projects is Trump’s family involved with?

Trump and his family are deeply tied to the crypto sector through World Liberty Financial, which issues a stablecoin (USD1) and a governance token (WLFI) valued at $4.5 billion. Family-linked firms hold 22.5 billion WLFI tokens, worth about $4 billion. Beyond that, they’re involved in Bitcoin mining (American Bitcoin), crypto funds, and ALT5 Sigma, which also holds WLFI. Trump has even promoted a memecoin, $Trump, attending a May dinner with its investors, including Chinese entrepreneur Justin Sun.

What’s been Trump’s impact on crypto so far?

Trump’s presidency and pro-crypto laws are pushing mainstream finance to embrace digital tokens as an investment class.

Trump has opened 401(k) retirement plans to crypto, with $19 billion flowing into U.S. Bitcoin ETFs in 2025. Unlike Biden’s SEC, which targeted firms like Binance and Coinbase, Trump’s regulators have dropped many cases and taken a friendlier approach. His appointees, including new SEC Chair Paul Atkins, are openly pro-crypto and working with the industry to shape favorable rules.

More than 100 so-called digital-asset treasury companies were formed to buy and hold digital coins on their balance sheets after financial regulators installed by Trump’s administration declared that most cryptocurrencies are not securities, which are more strictly regulated.

Crypto assets have hit record highs, with Bitcoin up nearly 65% since the election. The rally has spurred firms like Circle to pursue public listings.

Bitcoin Price Rose After US Election

The cryptocurrency reached an all-time high of $124,457 on August 13, 2025, before gradually falling back to $110,000.

How else has Trump encouraged crypto?

Trump named venture capitalist David Sacks as AI and crypto czar, ordered the creation of a U.S. “strategic Bitcoin reserve” from seized assets, and directed banks to serve the crypto industry.

Trump’s administration is embracing blockchain, with the Commerce Department publishing GDP data on public ledgers. The Genius Act promotes stablecoin payments, while the pending Clarity Act aims to reduce regulatory uncertainty for digital commodities and expand CFTC oversight, making crypto investments easier for institutions.

The industry is pushing to have a government Bitcoin reserve codified into law, with Senator Cynthia Lummis of Wyoming leading the effort.

Leave a Reply