Gold has surged to record highs at $3,609, rising 37% in 2025 after a 27% gain in 2024. Central banks are driving demand by favoring gold over U.S. Treasuries, reflecting a shift in how nations manage financial risk. Weak U.S. jobs data, expected Fed rate cuts, and growing speculative and retail interest are boosting the rally. The debate has shifted from gold as a safe haven to its potential role as the foundation of a new monetary order.

Key takeaways

• Gold price is at $3,609, supported by central bank demand and Fed rate cut expectations.

• US Treasuries are losing appeal, as central banks seek diversification in gold reserves.

• Traders are fully pricing in a 25 bps Fed cut on 17 September, while Gold has surged 37% in 2025, outpacing the S&P 500 and acting like a growth asset.

Gold vs US Treasuries: Central banks drive gold higher

Central banks, led by the People’s Bank of China (PBoC), are steadily reducing U.S. Treasury holdings in favor of gold, reflecting a structural shift in reserve strategy. Concerns over U.S. debt, political risk, and dollar volatility make Treasuries less appealing, while gold’s neutrality and liquidity strengthen its role as a hedge and diversification tool.

Fed policy and weak US data amplify the shift

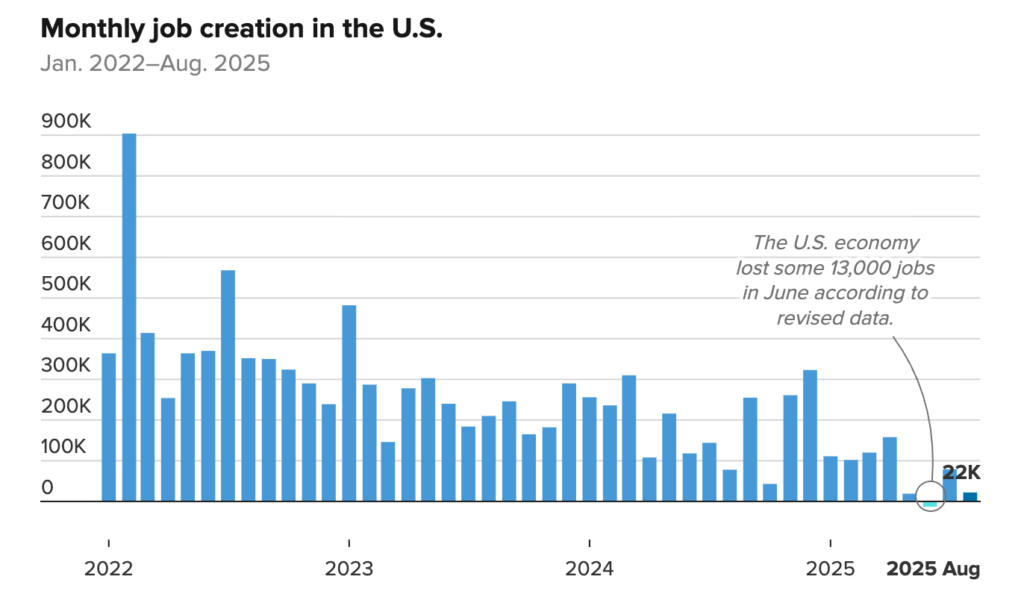

The latest US jobs report has reinforced gold’s momentum. Nonfarm Payrolls (NFP) showed only 22,000 jobs added in August compared to expectations of 75,000, while unemployment rose to 4.3%, the highest since 2021

Source: CNCB

Softening labor data has strengthened expectations of a Fed rate cut on September 17. Lower rates weaken the dollar and reduce Treasury yields, making gold more attractive to both central banks and private investors.

Speculative and retail flows add fuel

Speculative traders and retail buyers are reinforcing central bank demand for gold. Futures positions have surged, while currency weakness in markets like India is boosting retail investment. Together, official and private demand are providing strong support above $3,600.

Will prices decisively stay above $3,600?

Gold is now in price discovery mode.

• Breakout case: Central bank demand, weak US jobs data, and Fed cuts could lift prices decisively above $3,600, opening the path for a new trading range.

• Stall case: The near-term risk is the upcoming US inflation report (Thursday). A hotter-than-expected print could strengthen the dollar and delay a clean breakout, leading to a temporary consolidation before the next move.

Gold technical insights

At the time of writing, Gold is going parabolic, slightly going past the $3,600 mark – bullish signals are evident on the daily chart. The volume bars also tell a bullish story with buy pressure dominating over the past few days. If sellers don’t push back with conviction, we could see a decisive move past the $3,600 mark. Conversely, if sellers offer more pushback, we could see prices tank. A change in the fundamentals, coupled with profit-taking, could see prices crash to find support at the $3,315 and $3,270 price levels.

Disclaimer: The performance figures quoted are not a guarantee of future performance.

Leave a Reply