Financial markets are facing turbulence as two major forces— tariffs and inflation—shape a complex economic landscape. Recent trends in gold and copper markets highlight how these factors influence investor behavior and commodity prices. But which will have a greater impact on market volatility?

Let’s examine how these dynamics interact.

Gold climbs as tariffs and rate cut expectations align.

Gold, a traditional safe-haven asset, has been climbing, recently reaching $2,933 with a 0.63% gain. This rise comes despite typically bearish factors like higher US Treasury yields and a stronger dollar.

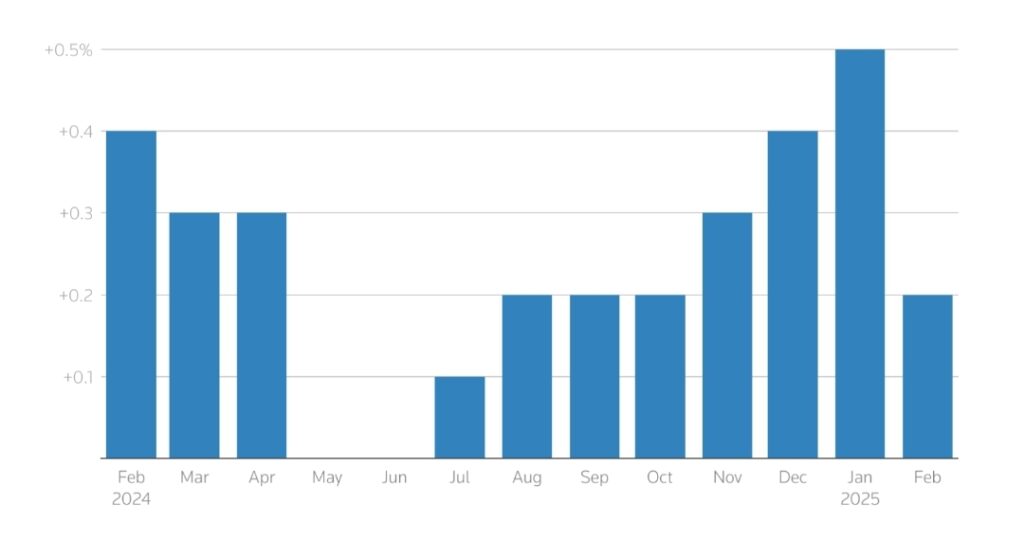

February’s US inflation data showed a modest 0.2% increase, easing from January’s 0.5% jump. This softer inflation has strengthened market expectations of potential Federal Reserve rate cuts.

Analysts warn that the recent inflation cooldown may be short-lived, as President Trump’s 25% tariffs on steel and aluminum could drive up import costs, sparking a new wave of inflation.

Experts note that lower inflation could give the Fed room to cut interest rates, a scenario that typically benefits gold, which thrives in low-rate and uncertain economic environments.

Inflation vs tariffs: The dual threat to market stability

The combination of tariff policies and inflation concerns is creating a highly volatile environment for investors. Aggressive import tariffs are expected to drive up costs, potentially reversing the recent inflation slowdown, while ongoing inflationary pressures continue to shape central bank decisions and market sentiment.

Meanwhile, recession fears are growing in the US, with President Trump describing the economy as being in “a period of transition.” In contrast, China is grappling with deflation, as its Consumer Price Index dropped 0.7% year-over-year in February—the sharpest decline in 13 months.

Central banks ramp up gold reserves.

Amid economic uncertainty, central banks continue to boost gold reserves. The World Gold Council reports that the People’s Bank of China and the National Bank of Poland added 10 and 29 tonnes, respectively, in early 2025. This sustained institutional demand is supporting gold prices, which analysts believe could soon test the $2,950 level.

The key question remains: Will tariffs and inflation be the biggest market drivers of 2025?

Their impact will depend on how they unfold. If tariffs fuel a fresh wave of inflation, market volatility could rise. However, if inflation stabilizes despite trade pressures, other factors may take center stage in shaping market trends.

Technical analysis: Key levels to watch

As of now, copper prices are trending upward, showing bullish signals as they remain above the moving average with a steadily rising RSI. Key resistance levels to watch are $10,000 and $10,145, while support levels to monitor are $9,338 and $8,970.

Gold is surging, approaching the $3,000 mark. While bullish momentum remains strong, an RSI above 70 suggests overbought conditions and a possible reversal.

Key levels to watch include $3,000 as an upside target, with support at $2,860 and $2,817 on the downside.

Disclaimer:

This blog article is for educational purposes only and does not constitute financial or investment advice.

Leave a Reply